The activities on this page cover creating a budget, bills and when they need to be paid, and the results of not managing money effectively. Discuss with students what types of decisions involving money can help a person "plan, save, and succeed."įor additional practice, have students complete the Bonus Plan, Save, Succeed! Worksheet: Cash or Credit? printable.Being able to create a budget and save money can help young people feel more confident about finances and plan for the short and long term. Step 10: Point out the Plan, Save, Succeed! Classroom Poster printable. After students have completed the questions, use your copy of the Answer Key: Plan, Save, Succeed! Worksheet printable to review answers with class. Step 9: Distribute the Plan, Save, Succeed! Worksheet: Budget Basics printable to students. (No, the family might go on vacation, decide to walk the dog themselves, etc.) Then ask what would happen if the family paying for the dog walking moved away and there was now no dog walking income? (Answers might include: find another family that wants its dog walked, cut expenses, etc.) What would happen if a second family wanted its dog walked and dog walking pay increased to $20? (Answers might include that the student could spend and/or save more.) Step 8: Ask the class whether or not the dog walking income is money the student can count on. Demonstrate to students that the expense categories add up to 100%. Ask the percentage of expenses for snacks (20%), music (40%), and entertainment (30%).

#CREATING A PERSONAL BUDGET LESSON PLAN HOW TO#

Demonstrate how to calculate percentage if necessary. Step 7: Ask students what percentage of monthly expenses is savings (5/50 = 10%). Answers will vary but should include increasing income and/or cutting expenses.

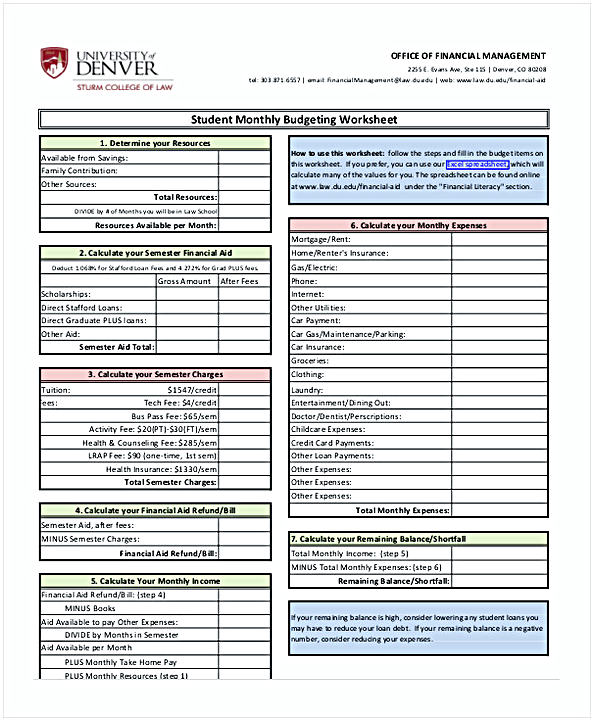

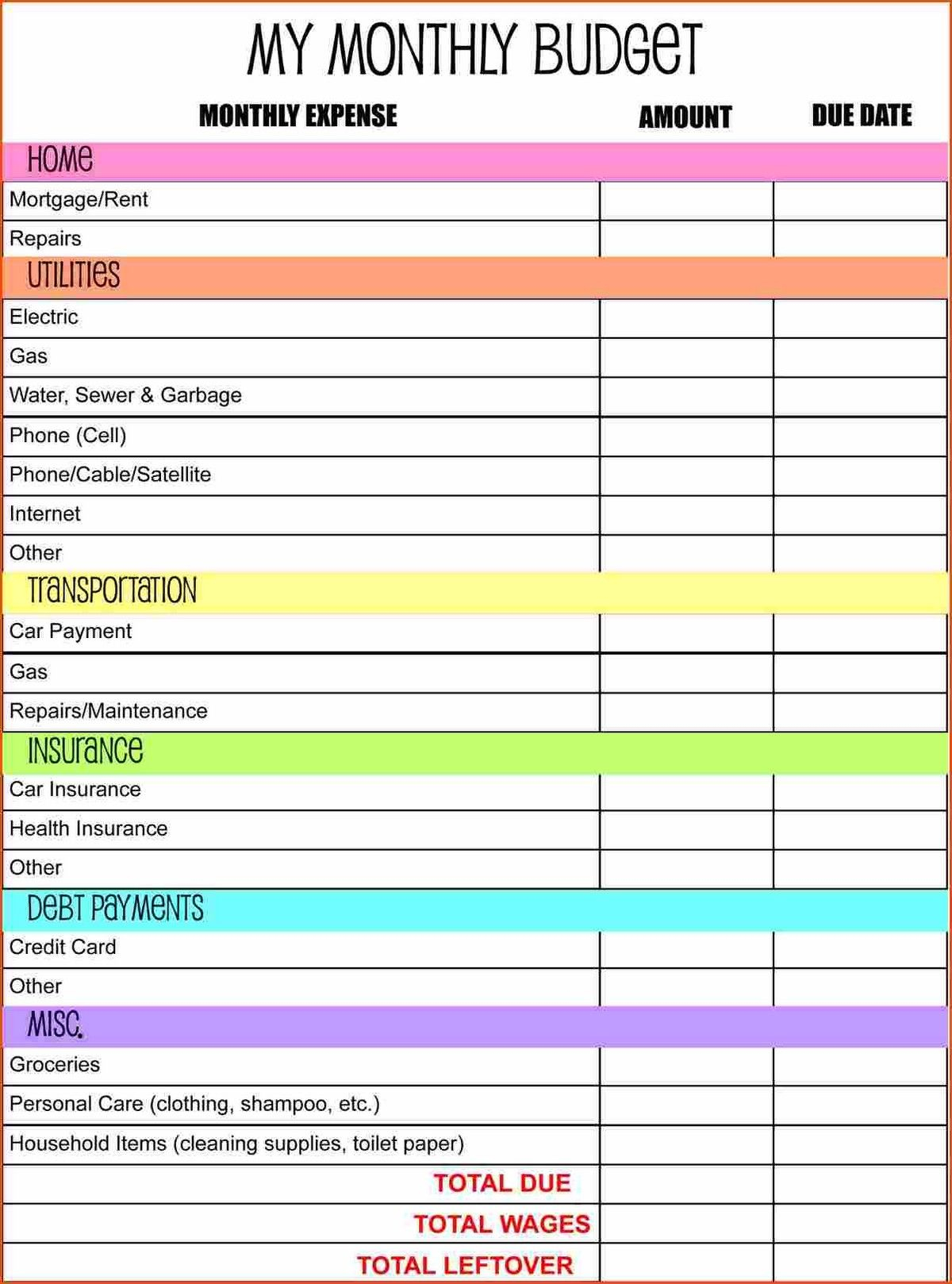

(Answers might include: keeping track of expenses, making sure expenses don't exceed income, helping set financial goals, etc.) To demonstrate, ask the class how this student could increase monthly savings for a large purchase in the future. Ask students why it might be useful to keep a budget. Step 6: Indicate that this is called a budget. (Show as "savings" under expenses and change "total expenses" to $50, equal to income.) Step 5: Ask students how to show the $5 difference between income and expenses. Step 4: Next rewrite the income and expense items in the form of a monthly budget: Income Indicate that the difference of $5 can be categorized as "savings." (Identify and group together income items and expense items, calculate totals, and compare the totals.) Indicate that the student has income of $50 per month and expenses of $45. Step 3: Ask if this student has enough money to meet the monthly expenses.

Step 2: Write the following sample student monthly expense and income information on the board (examples can be modified as appropriate for your class): Answers may include allowance from parents, chores, jobs, gifts, etc. Finally, ask students how they obtain the money they spend. Ask students to identify how they spend money (answers may include clothing, entertainment, savings, etc.).

Step 1: Ask students how much money a middle school student needs to "live" each month. Hang a copy of the Plan, Save, Succeed! Classroom Poster printable in your classroom where students can see it. Optional: Bonus Plan, Save, Succeed! Worksheet: Cash or Credit? printableġ. Make a class set of the Plan, Save, Succeed! Worksheet: Budget Basics printable.Ģ. Print a copy of the Answer Key: Plan, Save, Succeed! Worksheets printable.ģ.Standards Chart: Plan, Save, Succeed! printable.Plan, Save, Succeed! Classroom Poster printable.Answer Key: Plan, Save, Succeed! Worksheets printable.Plan, Save, Succeed! Worksheet: Budget Basics printable.Begin to consider the role saving plays in financial planning.Understand that mastery of fractions, decimals, and percentages can help address real-world situations.Understand how a budget is created and how it can support good financial decision making.

0 kommentar(er)

0 kommentar(er)